Flow&Ebb

Commodity Risk Management Platform

The Client

Flow&Ebb, based in London, is a consulting and technology firm in the area of commodity price risk management. It enables clients to better manage the risks of commodity market volatility and helps them build internal structures and policies to handle those risks whilst improving margins. Its partners are large corporate clients in North America and Europe.

Melon started working with Flow&Ebb in December 2016 when they approached us to develop a cloud-based commodity risk management tool. Their goal was to develop a piece of software that would automate the activities of a ‘middle office’, which provides high levels of governance and compliance for the buying activities of ‘front office’ buyers and traders.

The Project

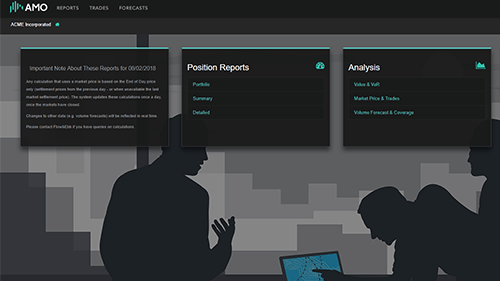

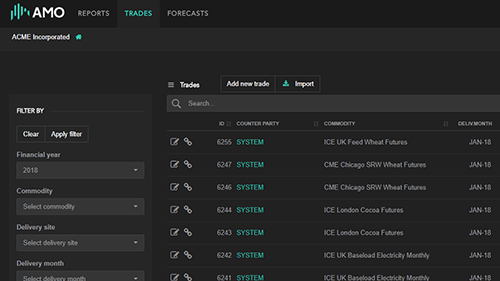

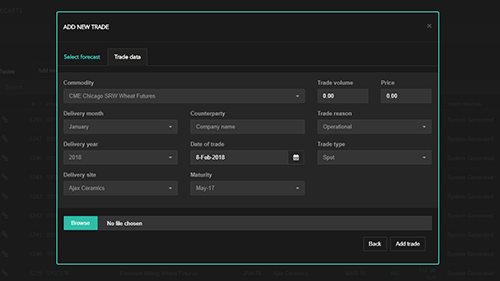

The platform's purpose is to manage the commodity price risk activities. It monitors and reports on a company’s risk position. It reflects a client’s business strategy and their risk policies, and captures their forecast and trading activities. Thus, the platform encourages teamwork and transparency since all activities and trades are visible to the users. If there is any action outside the agreed risk policy, the platform will immediately alert and prevent involuntary mistakes or breaching attempts.

All this data is combined with market prices to track, calculate and report performance. The market prices are updated on daily basis and the platform alerts the client of any price fluctuations.

The Process

Melon assigned a project manager to ensure the effortless continuity of the project. At the beginning, the client flew to Bulgaria to pin down the specifications of the project with our team. After that, the software development had two phases and the client was able to track the process through a management system.

During Phase 1, we developed a concept prototype including the bare minimum of the functionalities and reports generation.

In Phase 2, our team developed an intuitive and user-friendly web UI and added more reports generation options. The process was entirely agile with daily scrums, providing a demo every two weeks.

...

Flow&Ebb received feedback from their clients during development which shaped the final product we delivered.

We provided our client with expert training on how to manage the system back-end processes including SQL Databases.

In May 2017, we released the project’s first version. In 2018, we continue to provide system support services to Flow&Ebb, adding new features and enhancing existing ones.

Challenges

As a specialist in commodity markets, Flow&Ebb understood the framework of the system they wanted to develop but didn’t have the technical expertise in software development to know how to implement it.

We had to translate the esoteric commodity risk management calculations and processes into a cloud-based software. These calculations rely on highly complex mathematics, but our team was able to grasp the concepts, with the help of our client.

Another challenge was to convert the complex excel spreadsheets calculations into a functional system.

Results

- Аn efficient and intuitive commodity risk management platform;

- Daily commodity position and risk reports to clients;

- Full auditability and traceability of user actions;

- Secure way to record hedges and forecasts, and track of any breaches;

- Increased clients’ autonomy;

- Optimization of the whole business process;

- Substantial growth in new clients.